We are pleased to announce that now Rupiah Token (IDRT) has stronger liquidity on Uniswap. As one of the liquidity providers, our mission is to provide robust liquidity to give the users the best trading experience and low slippage on Uniswap. We are hoping with this liquidity improvement, we can minimize the slippage when users are swapping IDRT through Uniswap.

Meanwhile, Uniswap is a popular decentralized trading protocol that facilitates automated trading of decentralized finance (DeFi) tokens. What makes it different, Uniswap doesn’t use an order book to obtain the price of an asset or to match buyers and sellers of tokens. Instead, Uniswap uses a liquidity pool.

About UniSwap

Uniswap is a decentralized exchange protocol built on Ethereum. To be more precise, it is an automated liquidity protocol. There is no order book or any centralized party required to make trades. Uniswap allows users to trade without intermediaries, with a high degree of decentralization and censorship-resistance. Uniswap focuses on the strengths of Ethereum to reimagine token swaps from first principles. In September 2020, Uniswap launched its UNI governance token with an airdrop to anyone who had used the protocol before September 1.

How do trades happen without an order book? Uniswap works with a model that involves liquidity providers creating liquidity pools. This system provides a decentralized pricing mechanism that essentially smooths out order book depth. users can seamlessly swap between ERC-20 tokens without the need for an order book.

Since the Uniswap protocol is decentralized, there is no listing process. Essentially any ERC-20 token (including IDRT) can be launched as long as there is a liquidity pool available for traders. As a result, Uniswap doesn’t charge any listing fees, either. In a sense, the Uniswap protocol acts as a kind of public good.

The Uniswap protocol was created by Hayden Adams in 2018. But the underlying technology that inspired its implementation was first described by Ethereum co-founder, Vitalik Buterin.

How to Swap IDRT on Uniswap

Swaps in Uniswap are different from trades on traditional platforms. Uniswap does not use an order book to represent liquidity or determine prices. Uniswap uses an automated market maker mechanism to provide instant feedback on rates and slippage. you will first need to acquire some ETH for the gas fee and the IDRT token itself.

There are many ways to go about this, but the most popular is via a fiat on-ramp. First, you will need to head over to a centralized exchange that supports fiat currency such as Pintu. Fiat on-ramps will require that you provide ID and other details to allow you in depositing fiat & purchasing the crypto. Once you’re registered, you can fund your account with fiat currency and convert it over to ETH and IDRT. You can now send the ETH and IDRT to your non-custodial wallet (that supports UniSwap).

Now you’re ready for some UniSwap:

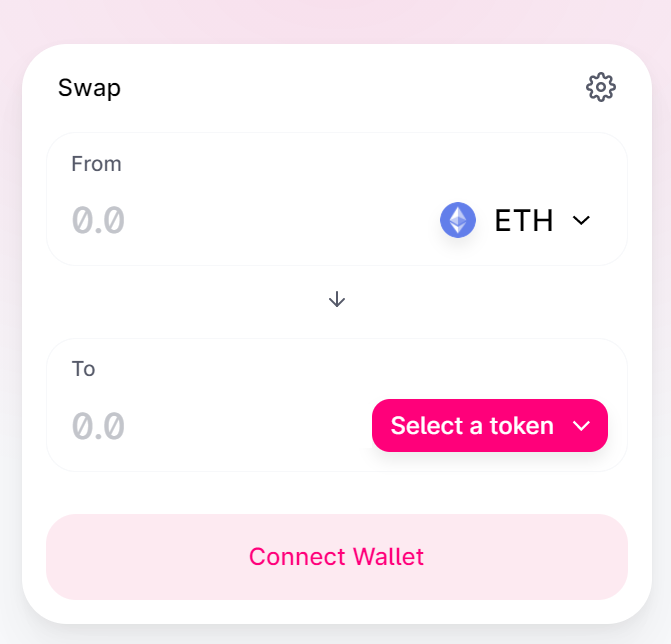

1. Open UniSwap on https://app.uniswap.org/#/swap

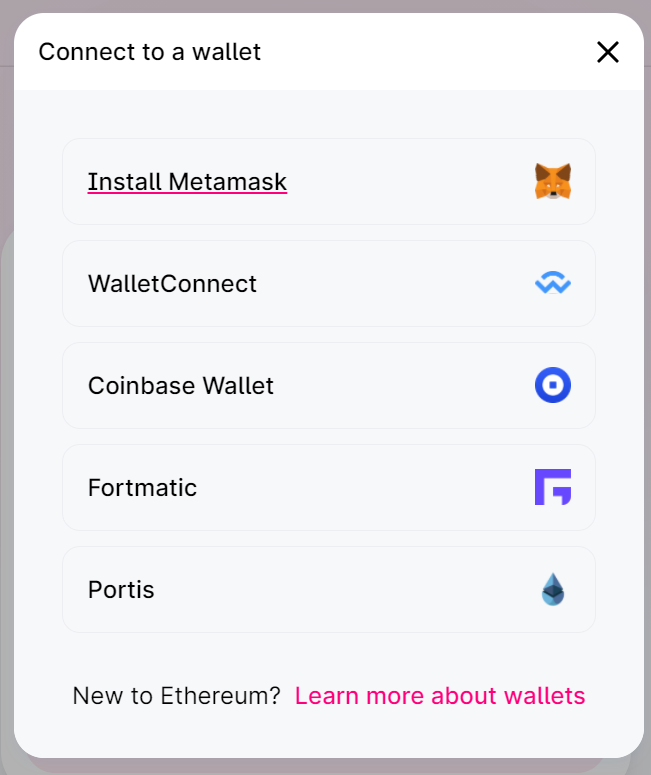

2. Connect your non-custodial wallet to UniSwap

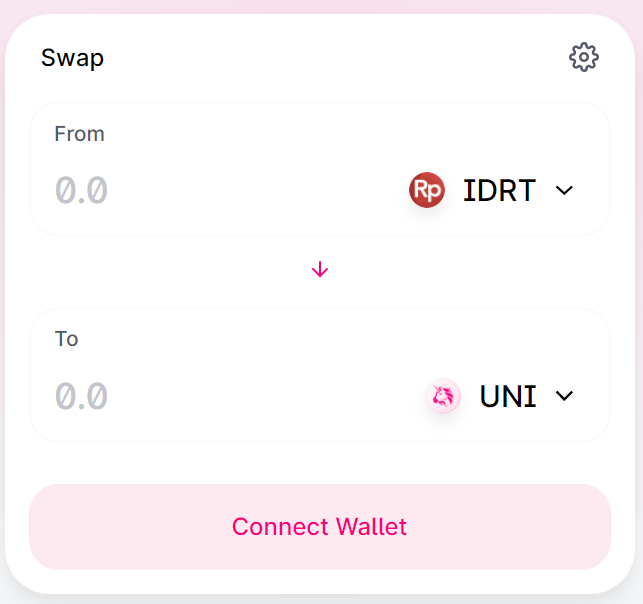

3. Choose IDRT to Swap with available tokens

And that’s how you use SushiSwap to swap any token from and to IDRT!

About Rupiah Token

Rupiah Token (IDRT) is a stablecoin that is backed 1:1 by fiat Indonesian Rupiah. IDRT is available on multiple blockchain namely Ethereum (ERC-20), Binance Chain (BEP-2), and Luniverse chain. We are the first and most adopted Rupiah stablecoin in Indonesia. The way Rupiah Token works, in a nutshell, is that our user can simply deposit 1 Rupiah Token for 1 fiat Rupiah and withdraw the Rupiah Token back to fiat Indonesian Rupiah at any time via our platform (https://rupiahtoken.com/) or via mobile wallet app (https://Pintu.co.id) We can always guarantee that the Rupiah Token is backed by fiat Indonesian Rupiah in our bank account and we are regularly audited by an independent auditor to prove such collateralization.